It amazes me how many insurance companies still rely on PDF processes for many customer needs. Clinging to outdated PDF-based processes is a surefire way to alienate your customers and even lose them to competitors.

The insurance industry aggressively adopted PDFs years ago because they represented a huge step forward from hard copies. They collected needed data and presented information in controlled, efficient, and often attractive ways. In many senses, they seemed tailor-made for an industry anxious to cut its reliance on millions of pounds of paper. Further, insurance data needs are large, and policy details, disclosures, and limitations are more complicated than many other products.

From this perspective, PDFs delivered massive benefits over snail mail, faxes and warehouses filled with documents. However, turning a fax into an email and a document warehouse into a database doesn’t come close to fully realizing the promise of digital transformation and automation.

PDFs create unnecessary friction in many places for the customer and the business. Consider:

For the Customer: Friction, Frustration, and Abandonment

Customer expectations have risen as web-based services have dramatically altered how people search, sign up for, and use most products and services. In a world of instantaneous Google results, Amazon One-Click purchases, and Netflix personalized recommendations, PDFs simply can’t compete.

Customers need to receive a PDF via email or proactively download it via a website. This disrupts the customer journey which drives up form abandonment. Even these small inconveniences can increase the likelihood that customers and prospects will give up and move on to a competitor with more streamlined processes.

Additionally, PDFs predate mobile and are therefore highly problematic on mobile screens, which now account for almost 60% of connected time. The fact that most PDFs are not responsive is reason enough to eliminate them from your digital strategy. When you are asking customers to provide information and complete a task, any friction can have a costly impact on your business.

For the Business: The Hidden Costs of PDFs

With all these issues, why do many insurance companies rely on PDFs? In most cases, it comes down to a lack of development resources or budget to digitize and automate these workflows. Sometimes, the significant added costs of using PDFs instead of digital forms are forgotten.

Customer-provided data is essential for developing rich profiles for analysis and personalized communications. Delays and transcription time add tangible and opportunity costs when manual data entry is required for processing PDFs. The need to manually submit data to your data and decisioning systems causes delays, making your go-to-market efforts less effective. In extreme cases, customers may be required to complete forms again or at least re-review information to make corrections. Each unnecessary process step adds to process abandon rates.

PDFs also increase the potential to introduce errors in your data when information is entered manually into company systems. Such errors can cause many problems – even application rejections and policy cancellations. Further, many companies still maintain PDF-based internal review processes, which create another set of inefficiencies and costs. When information is confined to PDFs instead of readily accessible in a database, these documents must be routed and reviewed in multi-step processes that slow decisions and frustrate consumers.

Finally, processes that use email and file transfer tools to submit and route PDFs also pose security and privacy risks. Information on insurance forms and applications is often highly personal. In a world of increased consumer and governmental scrutiny on data security, these weak points in your organization can cause major headaches and reputation loss.

Replacing PDFs with Effortless Digital Experiences

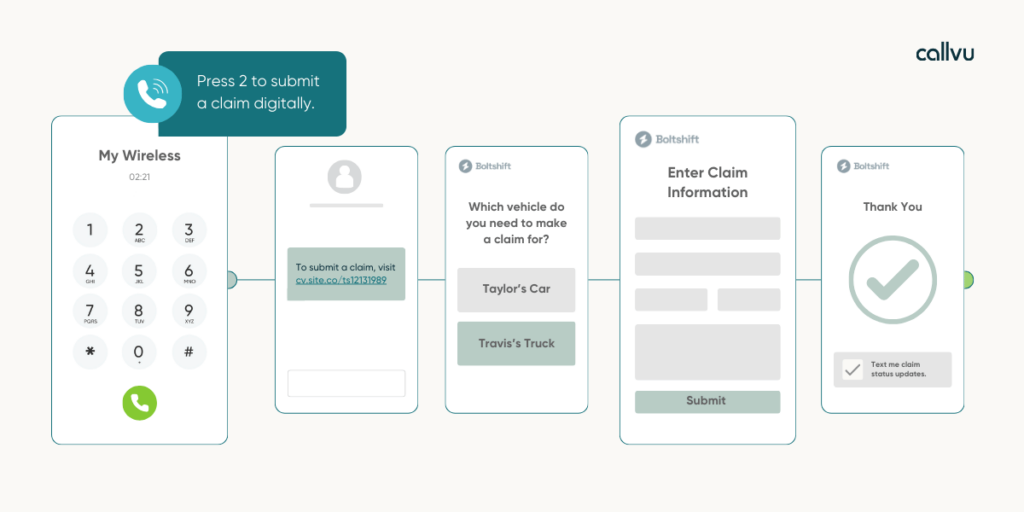

Today’s customers expect effortless experiences. They want to complete tasks quickly and easily on whatever device they choose. Many want to get a quote, purchase a policy, or file a claim without downloading a form or speaking with an agent. PDFs can’t meet these expectations.

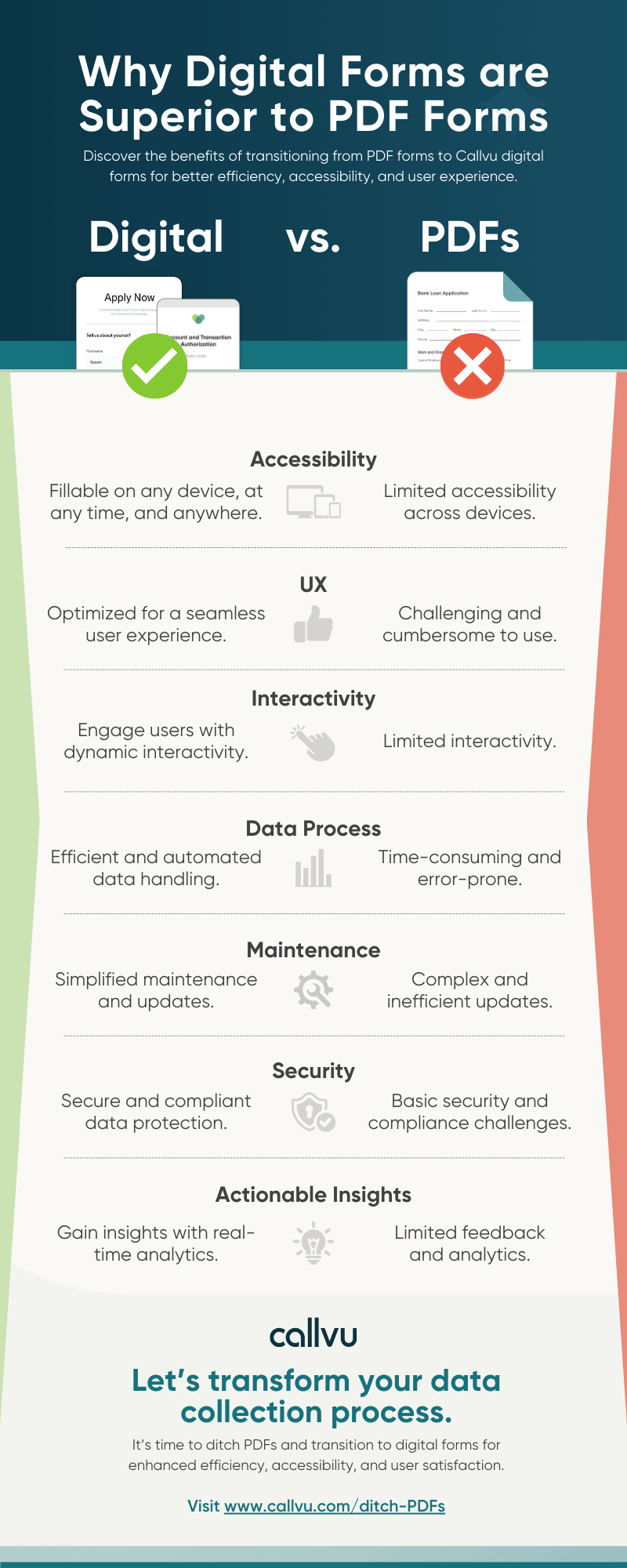

Insurance providers must replace PDF-based processes and adopt modern digital solutions to stay competitive. Digital forms offer a seamless, user-friendly experience that customers can complete on any device. They can be designed with built-in validation to ensure accurate information capture, eliminating costly errors and delays. Automation takes this further, streamlining customer-facing and internal workflows and reducing manual data entry.

The urgency for replacing PDFs has increased as tech-savvy competitors offer customers the effortless experiences they demand. Sticking with outdated PDF processes is a recipe for obsolescence. By embracing digital forms and automation, you can meet rising customer expectations and gain a competitive advantage. You’ll reduce costs, improve efficiency, and foster customer loyalty.

Take Action Now

Don’t wait until it’s too late. Take these actions now:

- Assess Your Processes: Identify all customer-facing processes that rely on PDFs.

- Research Solutions: Define the digital experiences required to replace outdated PDFs with effortless experiences that ensure data accuracy and real-time information access.

- Streamline Customer Experiences: Design digital forms and experiences focusing on ease of use, omnichannel compatibility, and focused workflows. Incorporate features like data validation to ensure information accuracy.

- Think Beyond the Form: Digital transformation is about more than just forms. Identify opportunities to automate steps in the customer journey and internal processes. Set goals for faster resolution of customer needs.

- Deploy and Optimize: Implement your new forms and processes and create a plan for ongoing testing and optimization. Iterate to make your workflows as efficient as possible to stay ahead of customer expectations.

By taking these steps, you will deliver inviting customer experiences that consumers find easy and satisfying while ensuring you stay competitive.