INDUSTRIES

By Use Case:

Trusted by Financial Services Leaders and Leading Businesses

Legacy systems create fragmented customer journeys that drive abandonment and put your customers at risk. Callvu enables rapid deployment of seamless digital banking experiences across all channels. Reduce costs and ensure compliance without extensive development resources or months-long timelines.

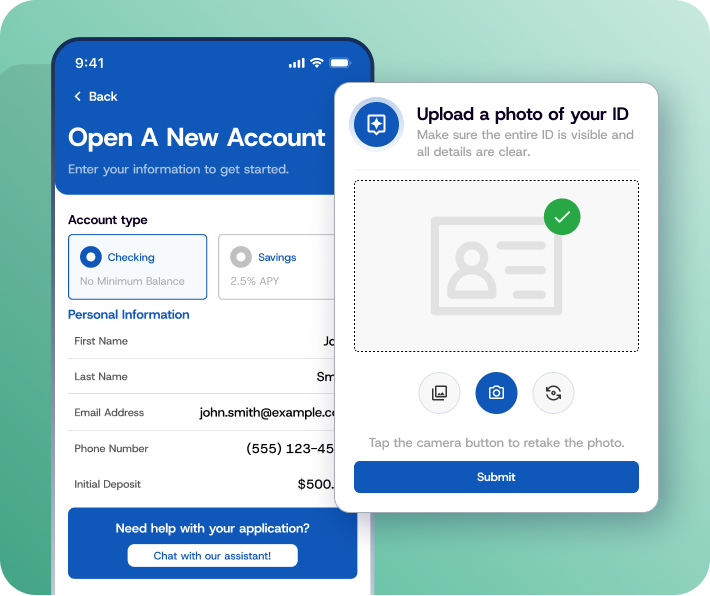

Transform frustrating paperwork into a seamless digital experience that captures and verifies customer information instantly.

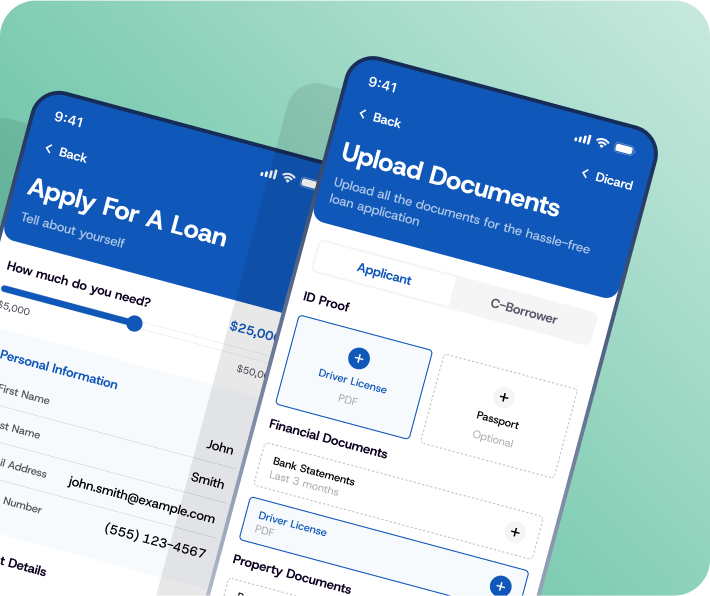

Guide customers through transparent loan journeys from application to funding with automated document processing.

Enable agents to share visual experiences with customers, showing solutions rather than trying to explain them verbally.

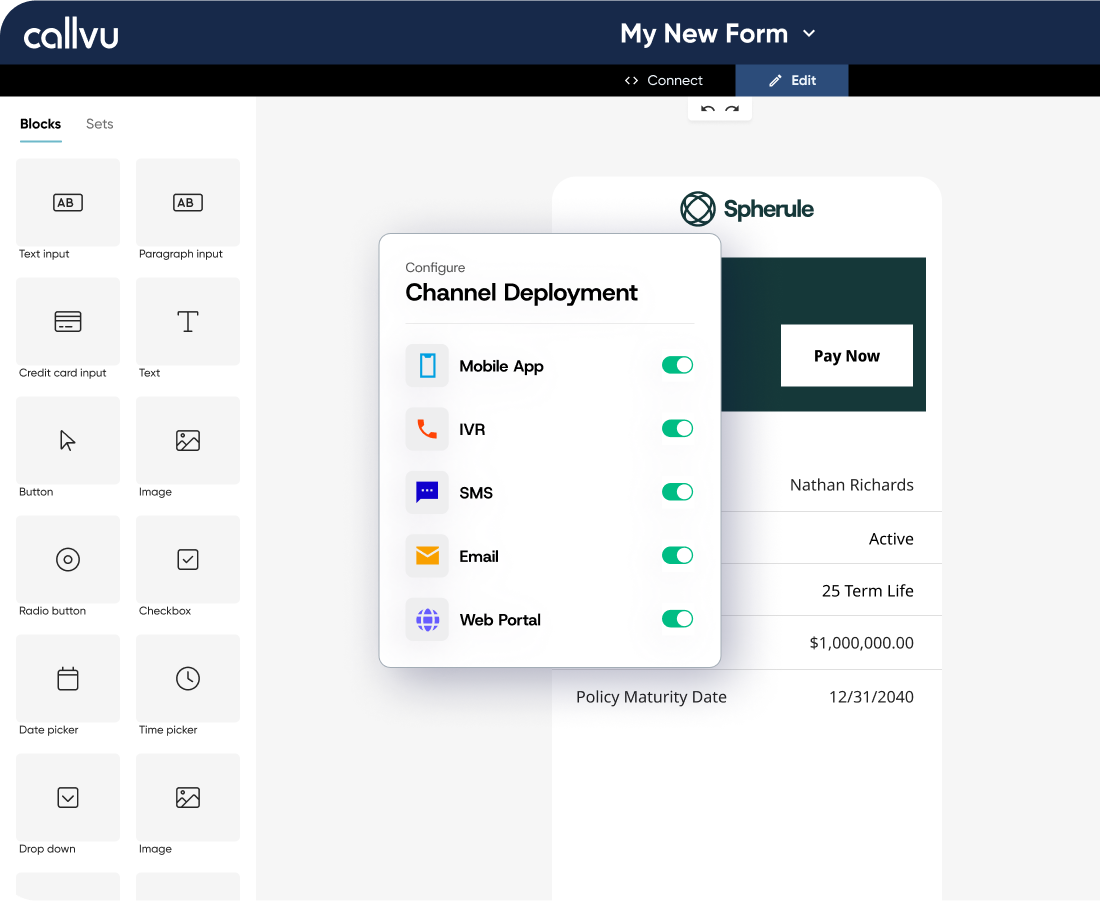

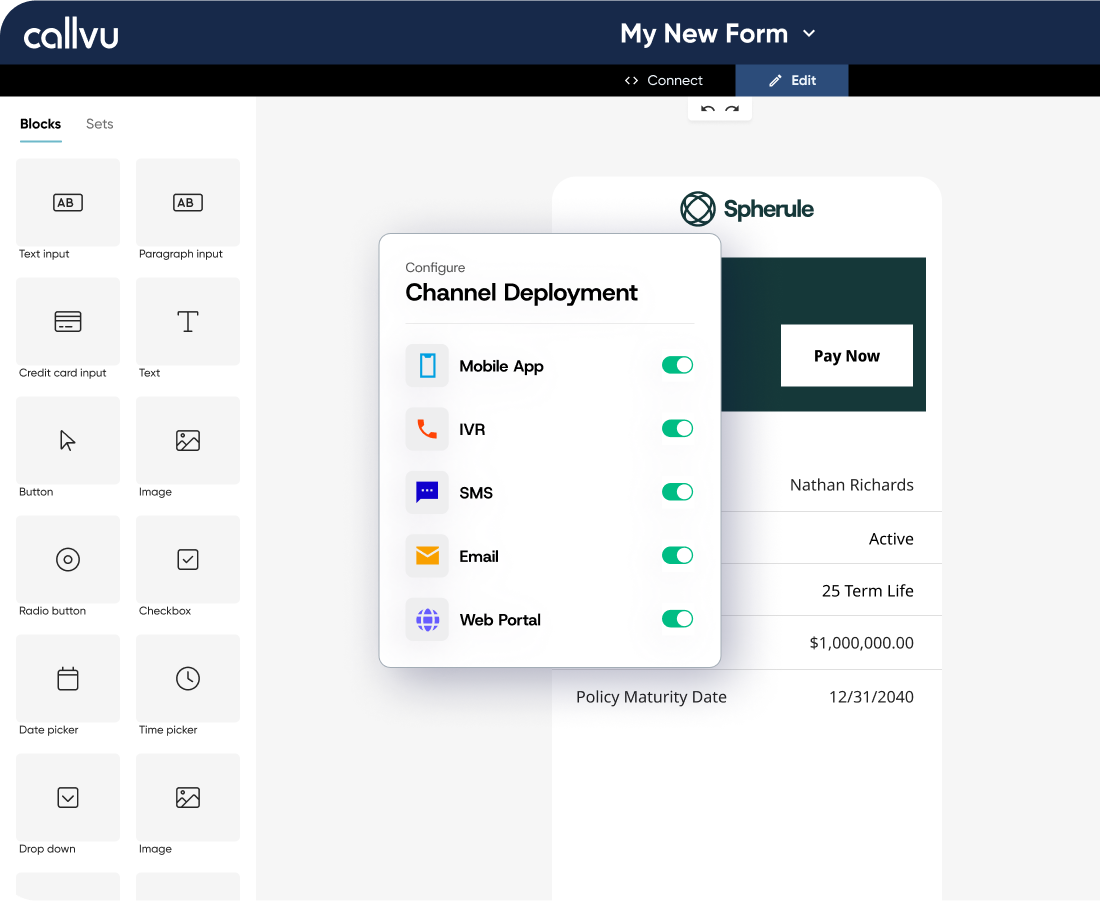

Let customers start and continue processes across any channel with complete continuity.

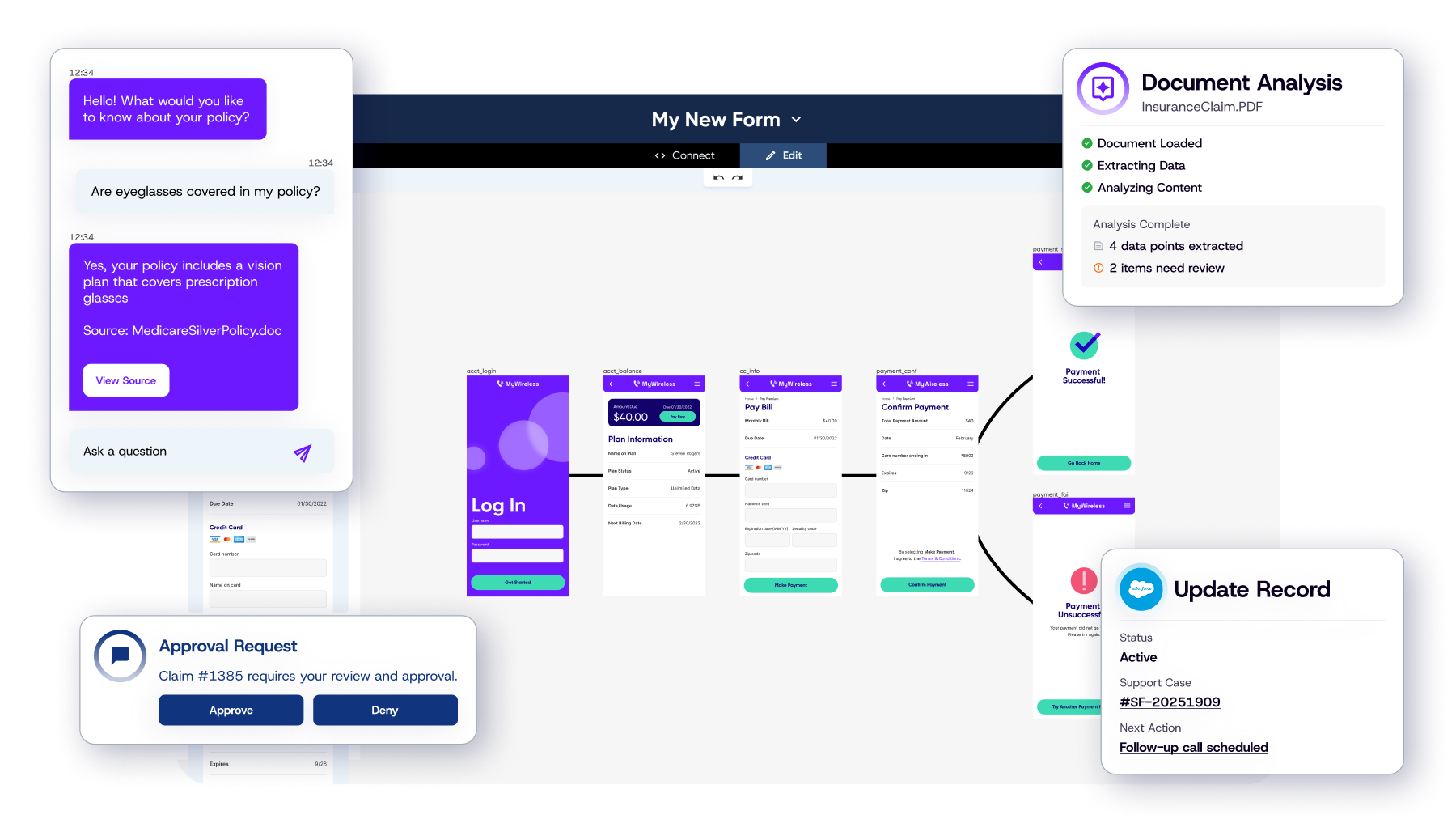

Embed AI capabilities that guide customers, extract information, and make completing forms intuitive and effortless.

Let customers start and continue processes across any channel with complete continuity.

Unlike traditional development cycles taking 6-12 months, Callvu’s no-code platform lets you launch your first self-service solution in as little as 2-4 weeks.

Callvu offers pre-built, customizable templates that dramatically accelerate experience development. Most clients implement new experiences within 2-5 weeks, depending on integration complexity and the sophistication of your banking and card management systems.

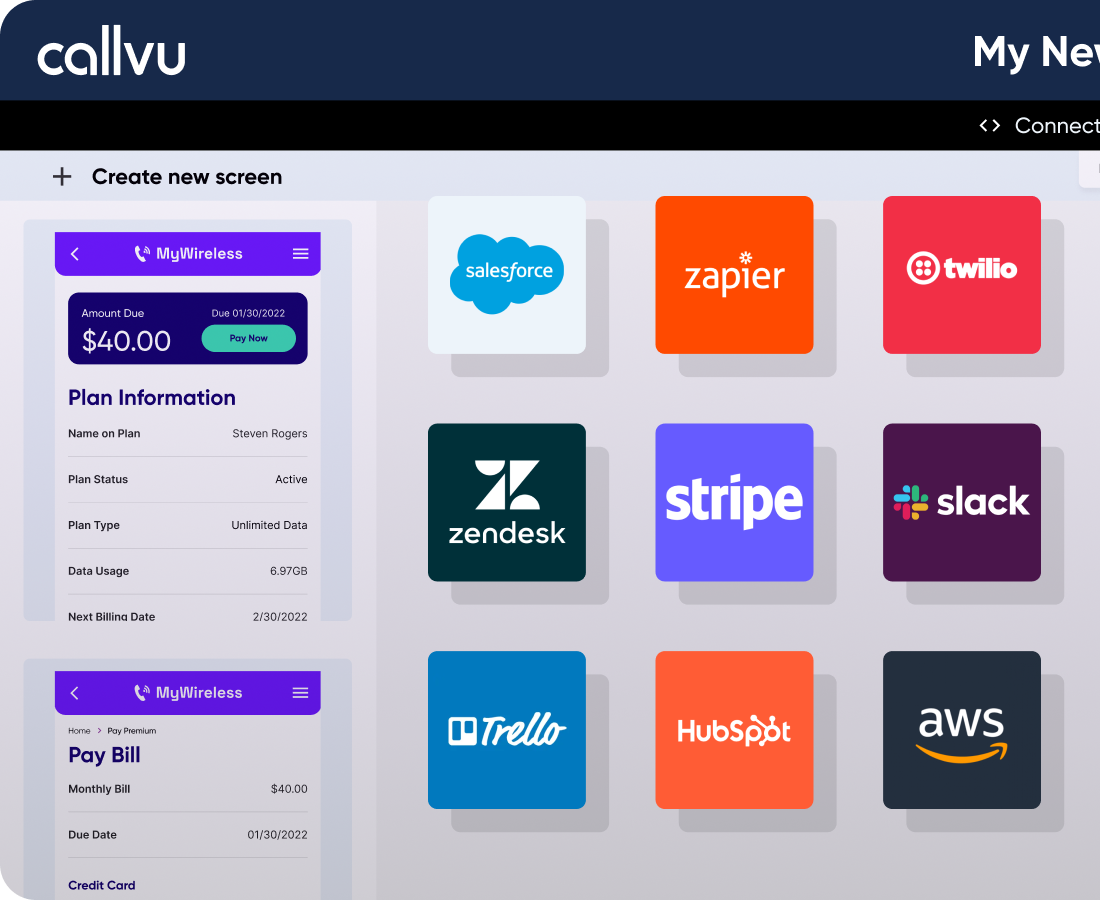

Callvu experiences integrate with all major core banking and card management systems through our pre-built connectors and flexible API gateway.

Most clients start with simple use cases that drive large numbers of calls to their contact centers. These calls often account for a large share of total contact center activity, but where agent involvement adds little value. Most companies start with one or two experiences as a proof of concept and then expand to more use cases over time.

Callvu experiences have been rated highly secure by many leading banking organizations, including some of the largest and most security-conscious companies. Callvu never stores customer information and is fully compliant with GDPR, CCPA, other national, state, and provincial privacy and security guidelines. Our client list includes many of the most security-conscious companies in the world, including Leumi, National Bank of Canada, US Bank, Visa, and MasterCard.

Callvu is designed to require minimal involvement from highly skilled IT developers. No coding skills are required. Less experienced IT team members can build with Callvu, or IT can simply review experiences built by others.

No. Callu offers several pricing options based on the expected frequency of usage for an experience. Contact us for full pricing information.

“We launched our new account opening experience in three weeks. Application completion rates increased by 60% while processing costs dropped significantly.”

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |