The Crisis of "Agent Toil": Why Digital Transformation Failed the Contact Center

For years, enterprises believed the path to efficiency was simple: add a chatbot, deploy a static online form, or implement a basic voicebot. This approach succeeded only in solving the simplest problems—the “low-hanging fruit”—while amplifying complexity in the background.

The result is a contact center paralyzed by “agent toil.” When a customer’s simple chatbot conversation fails, or when a complex transaction needs data verified, the task is escalated to a live agent. These agents are then trapped in a maelstrom of swivel-chair chaos, switching between multiple screens, manually re-keying data, and apologizing for siloed systems.

This systemic friction is the new hidden cost center. It leads to soaring Average Handle Times (AHT), high agent turnover, and massive volumes of “Not In Good Order” (NIGO) submissions, which trigger costly rework loops. Most current automation efforts miss the point: they automate the easy interactions but fail to provide true Contact Center Automation for the complex, high-value journeys that consume the most time and resources.

1. The Illusion of Fragmented Automation

Traditional automation falls apart the moment an interaction requires two things: security and completion.

When a customer needs to update sensitive KYC details, submit a legal document, or make a payment, legacy systems either force them back to the agent (risking PCI and PII compliance) or send them to a static, mobile-unfriendly website (risking abandonment). This is fragmented automation—it creates digital dead ends rather than seamless flows.

The cost of this fragmentation is measurable: every manual data-keying operation, every NIGO submission, and every escalation for a simple fix subtracts directly from the company’s bottom line, undermining the very premise of efficiency that automation promised. The next wave of competitive advantage belongs to those who eliminate this fragmentation entirely.

2. The Agentic Core of Contact Center Automation

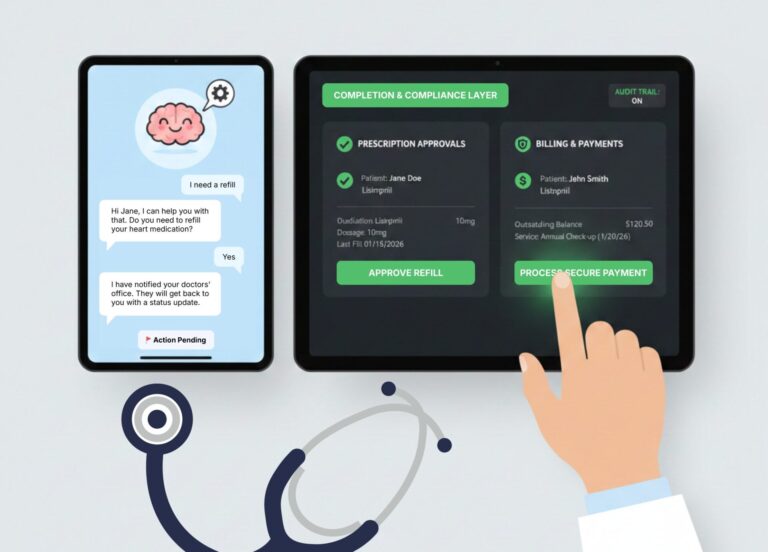

Callvu eliminates fragmentation by moving beyond traditional automation tools. Its core platform delivers Agentic CX Automation—meaning the system doesn’t just respond to a query; it actively manages the entire customer completion journey.

The system is designed to seamlessly bridge the voice and digital channels, turning any complex agent-assisted request into a secure, compliant, and guided self-service digital transaction via a mobile or web micro-app.

Callvu’s platform achieves true Contact Center Automation by focusing on three key transformations:

- From Conversation to Completion: When a conversational AI agent identifies an intent (e.g., “I need to file a claim,” or “I need to upload my ID”), the AI agent instantly triggers a secure digital micro-app sent via SMS, email, or WhatsApp. The Agentic platform then takes control of the compliance, validation, and completion steps.

- From AI Agent Scrutiny to System Enforcement: The platform guides the customer step-by-step, ensuring mandatory fields are completed, data formats are correct, and necessary legal consents (like e-signatures or payment authorizations) are captured compliantly—all before the data is submitted.

- From Manual Re-keying to Real-Time Integration: The clean, validated data is instantly structured and pushed directly into the backend CRM, WFM, or core banking system. No more swivel-chair, no more re-keying, and zero NIGO errors for digital submissions.

3. The Pillars of Operational Velocity

Effective Contact Center Automation must deliver results across the three core pillars of enterprise efficiency:

A. Friction Elimination (Cutting Toil)

By shifting millions of customer requests from time-consuming, agent-assisted voice calls or conversational AI dead ends to secure digital self-service, Callvu directly reduces support volumes by over 70%. This is not simple deflection; it is the automation of complex administrative tasks, freeing agents to focus on high-value sales and sensitive problem-solving. It converts time spent on data entry into time spent on strategic service.

B. Built-In Compliance (Eliminating Risk)

Compliance cannot be an afterthought. Callvu embeds regulatory assurance directly into its micro-app workflows. Whether it involves Know-Your-Customer (KYC) identity capture, payment processing, or securing legal consent, every field rule and regulatory requirement is enforced and logged automatically by the platform. This drastically cuts the legal and compliance turnaround time. It also dramatically reduces risk by ensuring that AI never touches sensitive backend systems directly. Each field, action, and transmission is logged for compliance. Governance is built in, not bolted on.

For an example of how this applies to high-security payment processing, see our insights on the Callvu Payment platform: What is IVR Payment? Your Guide to Secure, Frictionless Transactions.

C. System Integration (Ending Fragmentation)

The biggest drag on efficiency is system fragmentation. Callvu acts as a sophisticated digital layer, integrating easily with any existing contact center infrastructure—whether legacy IVRs, CRMs like Salesforce, or backend core systems. It uses robust integration APIs to push and pull data, creating one seamless, connected customer journey where information is always clean, validated, and up-to-date. This is how digital transformation pays for itself: through operational excellence, not overhead.

4. Measurable Impact: Speed Becomes Strategy

Callvu’s Agentic CX approach delivers quantifiable returns:

- 74% Faster Turnaround: Clients see dramatic speed increases for complex processes like legal document sign-off and loan applications. Approvals that once took days now happen in seconds.

- Massive Deflection: Leading organizations move hundreds of thousands of customer requests per month from costly agent interactions to guided digital self-service.

- Higher Customer Satisfaction (CSAT): By removing friction, the platform delivers instant gratification, resulting in 42% higher customer satisfaction scores. Happy customers complete. Delighted customers return.

Conclusion: The Strategic Imperative

For years, digital transformation meant adding a digital checkbox. But today’s leaders understand that simply digitizing a document or automating a greeting doesn’t create a digital journey. Banks and major enterprises that continue to depend on GenAI-powered channels, fragmented voice and digital systems face hidden liabilities, from re-keying errors and NIGO submissions to high audit risk.

Moving beyond basic automation isn’t a nice-to-have—it’s a competitive necessity. Callvu provides the solution: a complete Agentic CX automation platform that turns high-friction requests into secure, compliant, and efficient digital completions at scale.

What is Callvu?

Callvu is the Agentic CX Completion & Compliance Layer that turns conversational intent into verified, compliant digital actions. It bridges AI and backend systems for regulated industries by enforcing identity verification, disclosures, data validation, and audit logging inside secure micro-app workflows. This allows banks, insurers, and telecom providers in the US, UK, and EU to automate high-stakes service requests with guaranteed completion.

How does Callvu’s Agentic CX engine enable regulated contact centers to bridge conversational AI and backend completion workflows?

Callvu’s Agentic CX engine acts as the deterministic execution layer that sits between conversational AI and a company’s regulated backend systems. While AI can identify customer intent, Callvu ensures its secure completion by enforcing identity verification, required disclosures, data validation, and compliant step-by-step flows. This ensures that every high-stakes service request—such as authentication, payments, policy updates, claims steps, or account changes—is executed accurately, with audit trails and system-of-record updates. The result is a tightly connected bridge between AI-driven conversations and the regulatory-grade backend actions enterprises must enforce.

In what ways can Agentic CX help reduce average handle time (AHT) and compliance risk in enterprise customer service operations?

Callvu reduces AHT by shifting repetitive and regulated steps into automated, guided micro-journeys that customers complete on their own—often before or during the agent interaction. Processes like identity verification, form completion, document submission, and consent capture no longer slow down the contact center workflow. At the same time, Agentic CX reduces compliance risk by ensuring every required step is consistently followed, with no room for agent deviation, skipped disclosures, or incomplete data collection. This combination of automation and deterministic logic allows enterprises to speed up resolution while strengthening compliance posture.