Businesses are constantly seeking innovative ways to enhance customer experience (CX), streamline operations, and drive greater customer loyalty. These technologies have given rise to a new breed of customer service tools known as service micro apps.

Digital micro apps represent the next evolution of digital self-service, catering to customers’ constantly rising expectations of simplicity, convenience, and efficiency. Micro apps distill complex processes into bite-sized interactions. As technology evolves, micro apps are poised to become the go-to tool for completing quick tasks, further empowering consumers, and transforming how we interact with businesses.

This post outlines a broad range of customer use cases where digital micro apps may prove to be a popular addition to a company’s digital self-service experience menu.

Digital Micro Apps Defined

Before we review digital micro app use cases, let’s discuss these ultra-simple digital tools and their purposes. Digital micro apps are designed to simplify specific tasks and processes, making them more accessible and convenient for customers. They often have the following key characteristics:

- Single-Use-Case Focus: Each digital micro app addresses a specific customer service need, eliminating unnecessary features and complexity. For example, a digital micro app for checking a balance eliminates any input or information unrelated to this customer need.

- Streamlined Workflow: These micro apps prioritize simplicity and efficiency, allowing users to achieve their goals quickly. The number of steps to resolution is reduced to an absolutely minimum for minimal user fraction or potential process frustration.

- Multi-Platform Integration: Digital micro apps seamlessly integrate into existing digital platforms, providing a unified customer experience. Companies can continue to use the systems and processes they prefer – digital micro apps simply provide an easy-to-use customer layer on top of the existing tech stack.

- Multi-Channel Accessibility: They can be accessed through various channels, making them convenient for users to choose and access on their preferred devices. No matter the screen, the digital micro app adapts to it for maximized usability.

- Customizability: Digital micro apps can be tailored to meet the specific needs of a business or industry. While many customer experiences are common across providers, the digital micro apps for any business can be tailored to particular needs. They can be branded to integrate into the company’s overall brand aesthetic.

Digital Micro Apps and Personalization

One key benefit of digital micro apps is the ability to pre-populate certain fields with customer data, saving valuable time and effort. Imagine a scenario where a customer needs to update their contact information. Instead of filling out a lengthy form, a digital micro app could automatically retrieve the customer’s existing details, allowing them to verify, edit, and confirm the information.

Digital micro apps also offer advanced capabilities that further enhance the customer experience. For instance, automatic data validation ensures the accuracy of customer-provided information, reducing the risk of errors and delays. This is very relevant technology for many digital micro app use cases. Additionally, features like content upload, electronic signatures, and legal acknowledgments streamline complex processes, making them more efficient and user-friendly.

Digital Micro Apps and AI

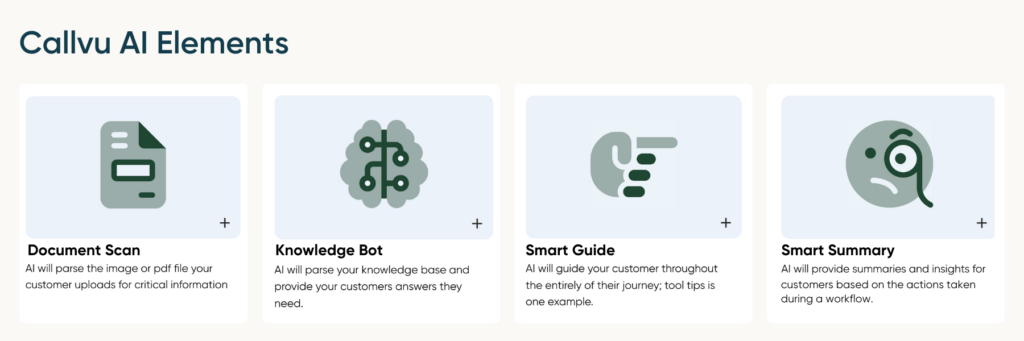

New solutions are making it incredibly easy to incorporate AI into micro apps. For example, our company has just introduced Callvu AI Elements — drag-and-drop AI modules that clients can integrate into digital micro apps developed in Callvu Studio.

Callvu AI Elements democratize the use of AI capabilities in digital customer experiences. These capabilities, which rely on client-controlled information sources to ensure accuracy and precision, add hyper-personalized content to dramatically reduce consumer frustration. These highly secure experiences are PCI, GDPR, and HIPAA-compliant and adhere to state and provincial privacy guidelines like CCPA.

Examples of the Callvu AI Elements modules we’ve launched so far include:

- Knowledge Bot: With this Callvu AI Element, customers can ask questions in natural language about policy coverage, plan details, and comparisons, for example, and have the Callvu digital micro app return accurate answers. The Callvu AI Element reviews and returns answers based solely on company-supplied information, eliminating the potential for irrelevant or inaccurate answers.

- AI Document Scan: This capability enables customers to upload a picture of a document or ID and have Callvu AI automatically detect and utilize information in customer service workflows. For example, a customer can upload an ID, bill, or insurance document, and the Callvu AI Element will detect information to accelerate accurate service delivery. This image data extraction dramatically reduces the effort required to complete forms and processes.

Callvu AI Elements reflect customers’ preferred methods of being empowered with AI in customer service. Recent research shows that while many companies are focusing all their resources on creating AI assistants like chatbots, 81% of consumers prefer different service options. When asked about specific uses of AI in forms and workflows, most consumers said they were interested or very interested in modular capabilities like Callvu AI Elements.

Using Digital Micro Apps to Automate Internal Workflows

The integration of digital micro apps with workflow automation is another game-changer. By automating repetitive tasks and processes, businesses can significantly reduce the need for manual intervention, freeing up valuable resources and accelerating issue resolution. This improves efficiency and customer satisfaction by providing faster and more responsive service.

From a business perspective, digital micro apps offer a multitude of benefits. By empowering customers to self-serve, companies can significantly reduce their support costs and data entry needs. Process automation also leads to more accurate data and faster turnaround times, resulting in higher customer satisfaction.

Moreover, quality digital micro apps provide enhanced security measures to protect sensitive customer data, addressing growing concerns about privacy and data breaches. This commitment to security instills trust in customers, fostering stronger relationships and loyalty.

Digital Micro App Use Cases for Different Industries

Many industries are adopting digital micro apps to help address their customer service bottlenecks, which drive up customer frustration and increase company costs. By offering a simple and self-contained digital solution, digital micro apps drive up digital self-service adoption. When agents use them during customer calls, they can improve first-call resolution and average handle time.

Banking Use Cases

- Balance Inquiries: Customers can instantly access their balance information through self-service after verifying their identity.

- Loan Applications: Would-be customers can start the application process immediately and gather documents at their own pace.

- Credit Card Applications: Applicants can conveniently complete applications online anytime without manual data entry.

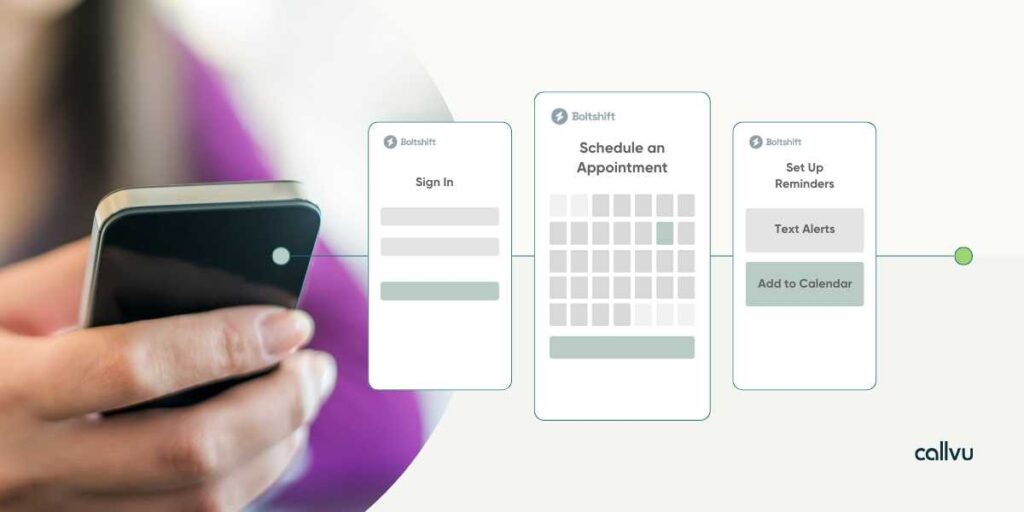

- Book an Appointment: Customers can easily view and select available time slots.

- Customer Onboarding: The onboarding process is streamlined with self-service options, reducing the need for agent assistance.

- Make a Payment: Customers can quickly and securely make payments without agent assistance.

- Transfer Funds: Customers can easily transfer funds between accounts without waiting for an agent.

- Update Profile Information: Personal details can be conveniently updated through self-service options.

Insurance Use Cases

- Get a Quote: Visual IVR can gather initial information for insurance quotes, allowing agents to prioritize opportunities.

- Insurance Applications: Applicants can complete applications through self-service or with assisted triaging.

- Customer Onboarding: New customers can be onboarded quickly and efficiently with self-service options, reducing support costs.

- Coverage Changes: Customers can easily change, such as adding new cars to their auto insurance policy.

- Bundle Purchases: Customers can make informed decisions by visually comparing bundled options in a self-service app.

- Book an Appointment: Customers can book appointments online, freeing up agent time for more valuable tasks.

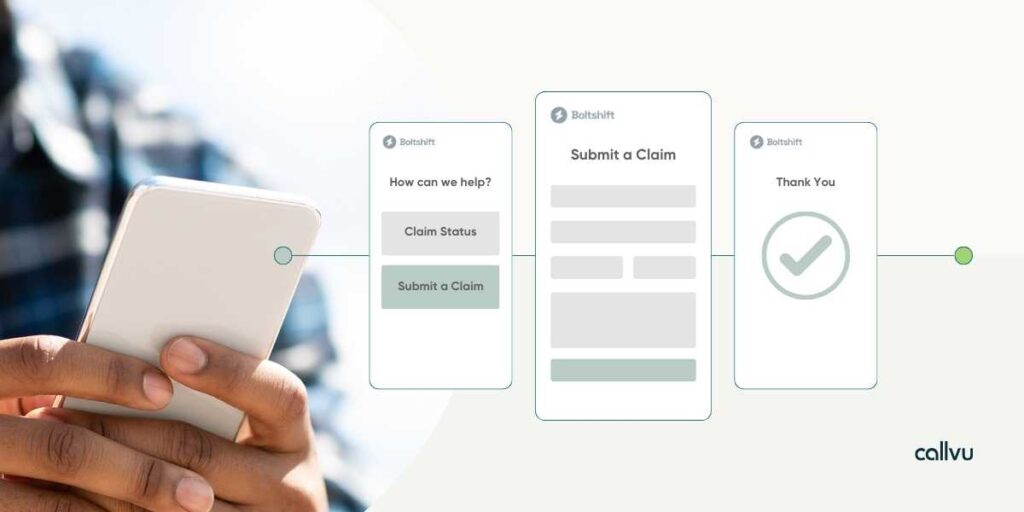

- First Notice of Loss (FNOL): The claims process can be streamlined, allowing customers to submit claims efficiently and gather necessary information.

- Claims Status Updates: Customers can check the status of their claims online, reducing the need for agent assistance.

- Provider Lists: Customers can instantly access approved provider lists based on location.

- Check Account Balance/Make a Payment: Customers can conveniently check their account balance and make payments online.

- Update Profile Information: Customers can easily update their profile information without agent assistance.

Healthcare Use Cases

- Patient Profiles: Comprehensive health profiles can be collected before appointments, reducing paperwork and wait times.

- Release Form Signatures: Release forms can be signed digitally for convenience and efficiency.

- Approved Provider Lists: Patients can easily access a list of approved providers and medical services.

- Book an Appointment: Patients can book appointments online, reducing the workload for administrative staff.

- Test Results: Patients can access their test results securely online, providing them with verified information.

- Check a Bill/Payment Due: Patients can easily check their bills and payment due dates online.

- Make a Payment: Patients can conveniently make payments online.

Telecom Use Cases

- Customer Onboarding: New customers can be onboarded online, deflecting calls and encouraging self-service.

- Transfer of Account Ownership/Add Users: Customers can easily transfer account ownership or add users through self-service options.

- Service Level Changes: Customers can compare and change service levels through visual comparisons.

- Check Balance/Make a Payment: Customers can conveniently check their balance and make payments online.

Other Use Cases

- Customer Onboarding: New customer onboarding processes can be streamlined for efficiency.

- Service Level Changes: Customers can make informed decisions about service level changes through visual comparisons.

- Check Balance/Make a Payment: Customers can conveniently check their balance and make payments online.

Conclusion

The versatility of digital micro apps, with their ability to streamline processes, enhance customer experiences, and provide valuable insights, makes them an indispensable tool for businesses across industries. From financial services to healthcare, micro apps offer a customizable solution that can be tailored to specific needs, use cases, and goals.

By investing in micro app technology, companies can unlock a myriad of benefits, including increased efficiency, reduced costs, improved customer satisfaction, and enhanced data collection. Micro apps’ adaptability allows them to seamlessly integrate into existing systems and workflows, making them a scalable and cost-effective solution for businesses of all sizes.

If you’re ready to explore the transformative potential of digital micro apps for your organization, we invite you to visit the Callvu website or request a demo. Our team of experts can help you identify the ideal micro app solutions to address your unique challenges and drive your business forward. Embrace the future of customer engagement with Callvu and discover how micro apps can revolutionize how you connect with your audience.