In a world where customers expect instant, mobile-ready experiences, the humble PDF has quietly become a hidden cost center. Banks that still rely on downloadable or printable forms—loan applications, account updates, change-of-address requests—are bleeding efficiency, compliance, and customer satisfaction.

Adding an e-signature doesn’t fix the problem. The problem isn’t the signature — it’s the document.

Every time a customer must print, scan, upload, or email a form, the digital journey stops cold. Each pause adds friction, drives abandonment, and creates compliance gaps that cost time, money, and trust.

Callvu eliminates the PDF altogether. Our platform transforms legacy forms into guided, compliant micro-apps that automate completion, validation, and back-office integration.

The result: customers complete transactions instantly, agents save time, and compliance becomes built-in — not bolted on.

1. From Static PDFs to Dynamic Micro-Apps

Traditional PDFs were never designed for mobile or omnichannel use. They force customers to pinch, zoom, and manually fill fields that don’t adapt to context or data. Callvu’s AI engine converts those rigid forms into intelligent, mobile-first micro-apps that guide users step by step — validating inputs, autofilling known data, and ensuring completion in one seamless flow. When friction disappears, completion rates climb. Customers finish what they start.

Static forms die; dynamic journeys win.

2. End-to-End Compliance, Not Just E-Signatures

A signature alone doesn’t equal compliance. Banks need full regulatory assurance across identity verification, data accuracy, disclosure delivery, and auditability. Callvu embeds compliance into every micro-app — from Know-Your-Customer (KYC) checks and ID capture to payment authorization and consent management. Every field, rule, and regulatory requirement is automatically enforced and logged.

No missing fields. No gray areas. No regulatory risk.

Compliance becomes invisible — and effortless.

3. Real-Time Data Automation That Cuts Cost-to-Serve

Every PDF that’s manually keyed into a core system is an operational drain. Validation errors, rework loops, and support calls waste thousands of hours each year. Callvu’s digital micro-apps capture, verify, and push structured data directly into banking systems in real time — no manual intervention required.

Banks using Callvu report:

- 70%+ reduction in support volumes

- Over 600,000 customer requests per month shifted from contact centers to digital self-service

This is how true digital transformation pays for itself: through operational excellence, not overhead. Automation replaces administration.

4. Faster Compliance and Legal Turnaround

Paper and PDF processes often stretch across days or weeks as customers download, print, sign, and return forms. Callvu eliminates that delay. Clients using Callvu’s compliant digital flows see up to 74% faster turnaround for legal and regulatory documents. Approvals that once required back-and-forth emails now happen in seconds.

That’s not just “digital transformation.” It’s operational velocity — the difference between being compliant and being competitive. Seconds replace weeks.

Speed becomes strategy.

5. Measurable Impact on Customer Satisfaction

Friction is the enemy of engagement. When journeys break, customers drop off or switch providers. Callvu’s guided completion flows improve both user experience and trust. Clients have seen 42% higher customer satisfaction scores (CSAT) and 9% higher loan acceptance rates by converting paper-based interactions into dynamic digital experiences.

When customers can complete a transaction instantly — whether opening an account or updating information — they stay, buy, and recommend.

Happy customers complete. Delighted customers return.

The Strategic Imperative: Beyond Digital Checkboxes

For years, “digital transformation” in banking meant adding an online form or e-signature. But today’s leaders understand that simply digitizing documents doesn’t create digital journeys.

Banks that continue to depend on PDFs face hidden liabilities:

- Re-keying errors that introduce data and compliance risks

- “Not in Good Order” (NIGO) submissions that trigger costly follow-up loops

- Audit risk caused by untraceable or fragmented document flows

Moving beyond documents isn’t a nice-to-have — it’s a competitive necessity. The question is no longer if banks should digitize, but how they can do so securely, compliantly, and at scale.

The Callvu Difference: Agentic CX Automation

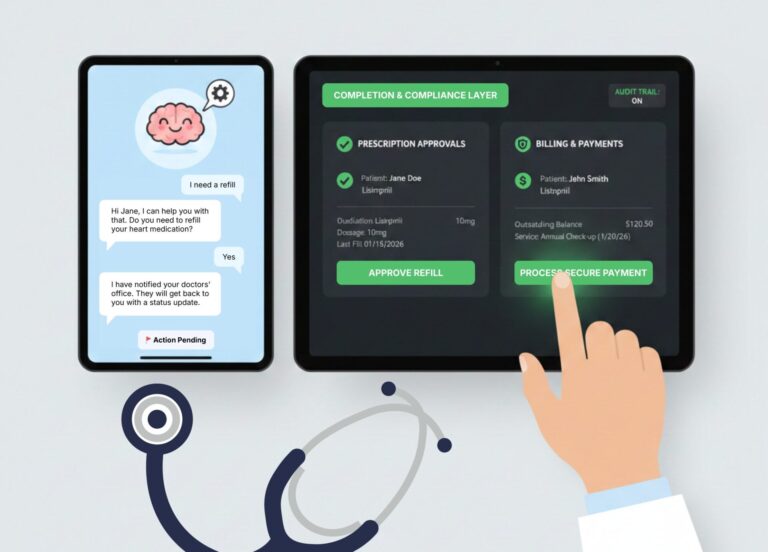

Callvu goes beyond traditional digital-form builders. Our platform is agentic, meaning it doesn’t just display forms, it actively manages the completion journey. The system guides users, verifies data in real time, ensures compliance before submission, and pushes clean data into your back-end systems.

This “completion and compliance layer” bridges the gap between conversational AI, contact centers, and back-office systems, turning any request into a seamless, compliant digital journey.

Whether embedded in a chatbot, agent assist tool, or web portal, Callvu’s micro-apps deliver secure, compliant self-service at enterprise scale.

Agentic automation turns intent into completion.

Retiring PDFs for Good

Across the U.S., U.K., Ireland, Australia, and Europe, Callvu has helped leading financial institutions eliminate more than 10 million pages of paperwork. We’ve seen banks cut processing times by 74%, move millions of customer requests to self-service, and regain control of compliance, all without adding development resources or IT backlog. The future of customer interaction in banking isn’t about digitizing paperwork. It’s about designing intelligent, compliant, and connected experiences from the start.

Stop printing money. Start creating digital value.

See how Banca Transilvania cut legal sign-off times by 74% with Callvu’s AI-powered micro-apps.

Visit our blog for more insights.

What is Callvu?

Callvu is the Agentic CX Completion & Compliance Layer that turns conversational intent into verified, compliant digital actions. It bridges AI and backend systems for regulated industries by enforcing identity verification, disclosures, data validation, and audit logging inside secure micro-app workflows. This allows banks, insurers, and telecom providers in the US, UK, and EU to automate high-stakes service requests with guaranteed completion.

What are the key cost and compliance disadvantages of PDF-based workflows, and how does Callvu convert them into automated digital journeys?

PDF-based processes are slow, error-prone, and expensive: customers must download, print, fill out, scan, and resend documents, often resulting in missing data, illegible fields, or incorrect disclosure acknowledgments. These issues create operational waste, compliance gaps, and high abandonment rates. Callvu eliminates these problems by transforming static PDFs into intelligent digital journeys that collect structured data, guide users step-by-step, enforce mandatory fields, and capture signatures and evidence inline. Every submission is validated, compliant, and ready for backend processing—no manual cleanup or chasing customers for corrections.

How can financial institutions leverage Callvu’s platform to transform document-heavy processes into compliant micro-apps with audit-friendly completion?

Financial institutions use Callvu to break down complex, document-heavy workflows—such as account opening, KYC verification, claims intake, or lending forms—into compact micro-apps that ensure every required step is completed correctly. These micro-apps enforce identity checks, data accuracy, dynamic disclosure sequencing, and digital signature capture, and they generate full audit logs for every interaction. Because the journeys are deterministic and rules-based, banks and insurers can automate processes that previously required manual review, reducing cycle times while increasing regulatory confidence.