Artificial Intelligence is poised to reshape the way we interact with financial institutions — potentially transforming the nature of banking itself. CX leaders are naturally excited by the ways AI will improve bank-customer interaction. But are consumers ready for banking customer service AI? Specifically, for the specific types of AI tech currently in development?

Major Consumer Survey on AI in Customer Service

Judging by the results of the nationwide survey Callvu just conducted, consumers are just not there yet. The study of almost 600 consumers showed that while more people believed AI would make their lives better in the future than thought it would make their lives worse (36% v. 28%), many customers doubt AI assistants’ ability to solve problems quickly and easily.

Despite the increasing deployment of AI assistants by many banks and financial institutions to reduce customer wait times, the survey results underscore the importance of human agents in the customer service process. A significant 81% of respondents expressed a preference to wait to speak with a live person rather than use an AI assistant. When asked to compare the effectiveness of ‘people’ and ‘AI’ in solving customer service problems, human agents emerged as the clear winners on most dimensions, underscoring their irreplaceable role in the customer service journey.

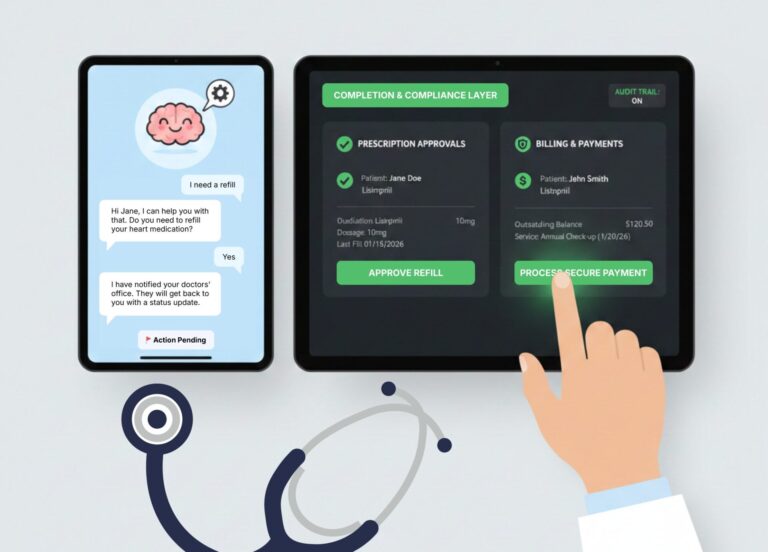

There were bright spots in the data for banking CX teams that were anxious to implement more AI. The public was very receptive to AI solutions that helped reduce mundane steps in digital banking and support requests. Seventy percent would like AI tools that proactively alert them to issues before they arise. If stuck, 60% wanted access to AI helper tools to guide them through self-serve experiences. Sixty-three percent welcome banking customer service AI tools that can analyze a photo ID and transcribe information into forms, and 54% like the idea of AI biometric tools to automate logging in. So, while consumers appear open and optimistic about the benefits of AI in customer service, there is far less enthusiasm for working with AI assistants. Call

Overcoming Barriers to AI Adoption

Digging deeper into the results, we found barriers to acceptance in the following areas:

- Trust: Concerns around data privacy and security loomed large for many consumers. Respondents said they believed people would be better than AI assistants at protecting their data.

- Access to Actual People: Many share the concern that companies will use AI to prevent them from accessing human support when they need it. From their point of view, AI is a blocker versus streamlining the path to support.

- Usability: Of course, not every customer is tech-savvy. It’s important to design AI solutions with an emphasis on user-friendliness. Many consumers told us they felt AI would increase, rather than decrease, the likelihood that resolving their issues would require multiple calls.

- Human impacts: In the write-in responses we collected, the second-most-cited concern was that AI would cause mass layoffs and damage the economy.

It would be easy to argue that customer acceptance of banking customer service AI will be gradual.

Winning Strategies for Banking Customer Service AI

Successful banking customer service AI adoption requires a holistic strategy that tackles customer concerns, demonstrates tangible value, and builds trust. Four principles are essential:

- Transparency on goals: Many people told us that companies want to deploy AI assistants primarily to cut costs rather than improve service. Financial institutions should emphasize customer service benefits when they develop and implement AI strategies. Controlling bank costs is not your customers’ concern.

- Clear communication and education: Proactive campaigns should inform customers about AI’s benefits. By highlighting increased security, improved convenience, and faster issue resolution, we can showcase AI’s real value proposition for banking. Using clear and non-technical language will help demystify this technology for the everyday customer.

- Solving problems on your customers’ terms: Our survey data showed that consumers are frightened that AI tools will replace people entirely, but would welcome AI’s help with the drudgery of banking forms and seeking support. By focusing attention on these capabilities, banks can demonstrate the power of AI to improve customer experience with every interaction. We should also keep in mind that AI isn’t necessary or even suitable for many simple customer interactions. Our respondents expressed a strong preference, for example, for simple mobile-friendly forms over having to chat or make voice commands to an AI assistant.

- Phased implementation: Banks should deploy AI gradually. Begin by offering customers a choice of using new solutions or continuing to leverage legacy processes. By starting with low-risk use cases, such as routine inquiries and simple transactions, banks can deliver tangible value and accelerate outcomes while maintaining customers’ access to human support. A gradual adoption process will enable customers to familiarize themselves with AI assistants and other applications, building confidence over time.

Think Through the Banking Customer Service AI Plan

AI is driving intense and rapid change throughout society. Financial insitutions must tailor the deployment and timing of banking customer service AI AI initiatives with a consumer-first mindset. In our exuberance over this technology’s potential, we mustn’t take actions that customers don’t want or won’t accept. By getting our strategy right, we can transform customer experience for the better, and create lasting competitive advantage.